Real Estate Investing 2024

by Lee Seward

Real Estate, Construction, Contractors, Custom Homes, Home Equity, Home For Sale, Home Remodeling, Housing Market, Property For Sale, Rebuilding Homes, Remodeling, Renovation, Repairing Home, Uncategorized

What is more exciting than SOLD in regards to your Investment?

Sold Single Family Homes December 2023

SOLD Single Family Homes Past 30 Days 2023

It is a great feeling when your investment sells and it is a greater feeling when it sells in the timeline you planned.

What is the secret?

Location, build something of value for your market buyers, spend wisely, build what makes sense.

That is the boilerplate answer.

The real secret is to execute and know what is involved. As a hands on developer, I seek lots without obstruction, nice streets, obvious great neighborhood, but the surrounding homes and neighbors are important. Never a corner lot, they are much less valuable as you need more room to fit a home. Per zoning regulations corner lots have two front yards and that pushes the building parameter close to the sideline leaving little room and less desirable conditions. Downhill or sloping downwards lot is a hard NO unless you can bring in fill. Purchase price, there is a ceiling number go above that number and you are not profitable. Just because a house sold for X around the corner does not set the ceiling for the property you need. Cash purchase, or finance, it is all the same. Taking money out of something to use to purchase property costs interest in some format just as borrowing money.

What to Pay for Land?

I am asked often for advice on what should someone pay for a lot? What is the formula?

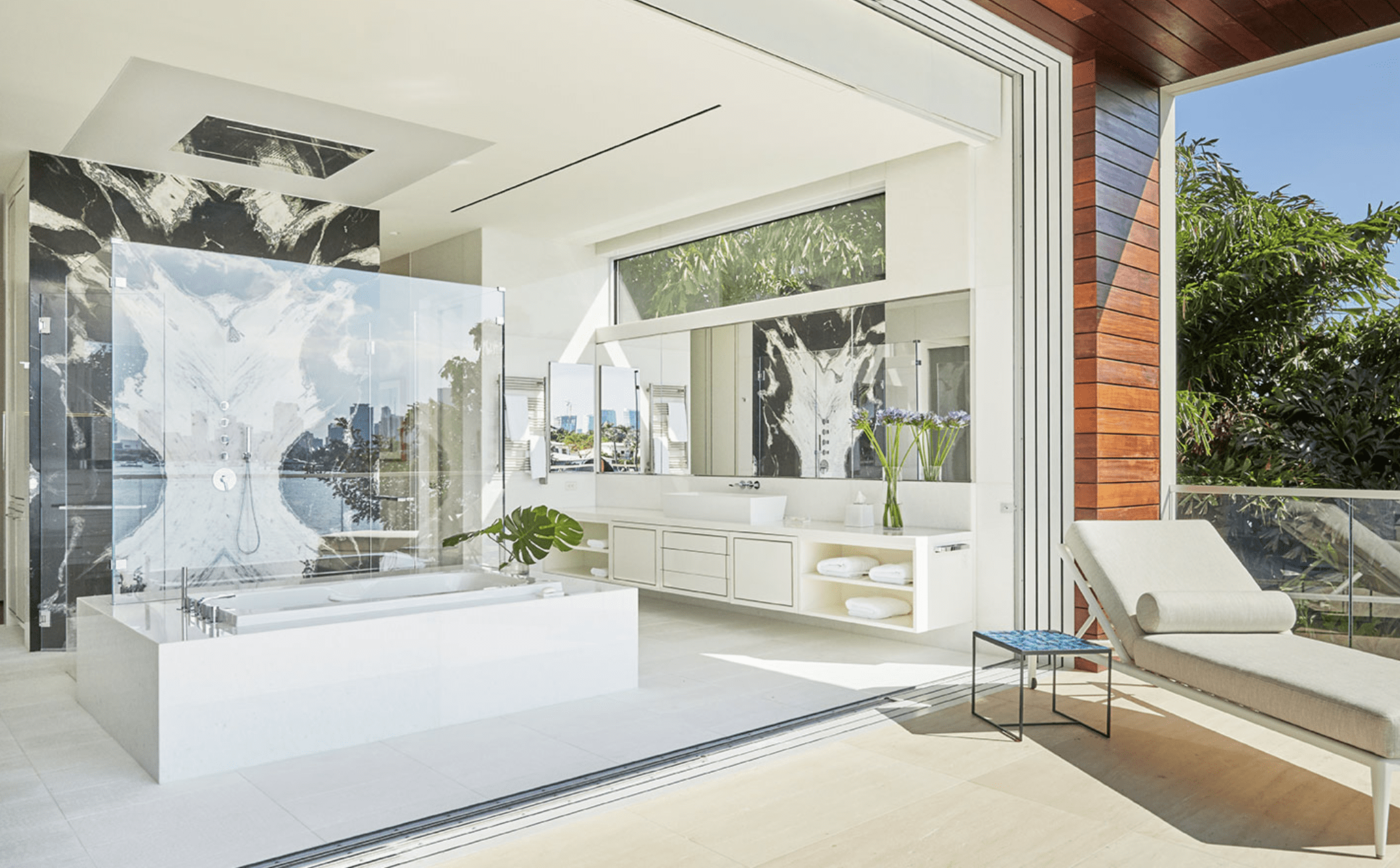

Here is the answer, you need to know the market, the finish home size and the sold price. What has been selling in the area? That is the ceiling, not the highest sale but the lowest sale of a new home in the area you choose. The lowest sale price of new construction within 6-12 months. Then you need to see what was in the homes that sold, how many bedrooms, bathrooms, what type of finishes, lot sizes, etc. Now you have built a ceiling, an X sft home with X bedrooms, X bathrooms and X finishes cost $X.

With the ceiling you can come up with a per ft cost to build then finalize what the purchase price ceiling has to be for the area. There is no other way to know a lot cost and just chucking numbers without doing homework is fruitless. Your realtor cannot set the lot ceiling price or tell you a great price, you can never compete with end users who may be bidding against you. They are buying to live, you are buying to develop and flip. You need to cover costs, plus time (time to develop, time to sell, time for market corrections if you get caught in a down cycle).

Timing

Timing is the key to success. Even if you slightly overpaid for a lot, you may have a chance to be profitable if you can execute.

For me the selling market dictate when I need to complete a home. The cycle, in some areas buyers are out in the spring after bonuses are out and the temp breaks. Other areas it is the winter when buyers migrate from the northern areas looking for a second home. When you obtain your building permit the clock starts. You need to execute and create a timeline for your completion date. If you hurry can you finish during a strong market? If you wait will interest rates be lower? If you hurry will you be finished so you are ready for the spring pop? These are huge factors in building successfully. I have seen builders fold and the common thread is they do not have the ability to execute. Many have the gift of gab, this lets them raise millions but few can execute and at some point everyone gets lucky until luck runs out.

We execute and have a track record of doing so. It is easy to do and you can do it also. The key is to use the downtime of waiting for permits to build your home on paper. Basically price out everything, select everything, have it ready to purchase and store it. Line up all of your trades and when you receive your permits and we actually work with our subs to set the pace of the job. That effort and drive created builds momentum that pushes you forward to completion.

If you are building and heading in to a down cycle you may decide to take it easy. In this case you wait to hire and purchase items or trades. You seek the best deal and pull the trigger. This will offset the cost of time, it may not be something worth doing if you are using debt. It is also something I am not personally wired for. I would rather finish the job as quickly as I can then refinance and rent to hold or leave on the market to sell. I prefer to be in control of a completed asset rather than one in perpetual construction.

Profit Margin

Related Posts